Tokenisation 101: A whole new world of investment opportunities, and why it matters

Tokenisation has radically shaken up the investment universe. Tokenisation is the way that real-world assets are represented as tokens on a blockchain. A token is a digital asset that can be traded and managed on the blockchain, offering benefits such as fractional ownership and increased liquidity. The underlying real-world asset remains, and the token serves as a digital representation of ownership or value.

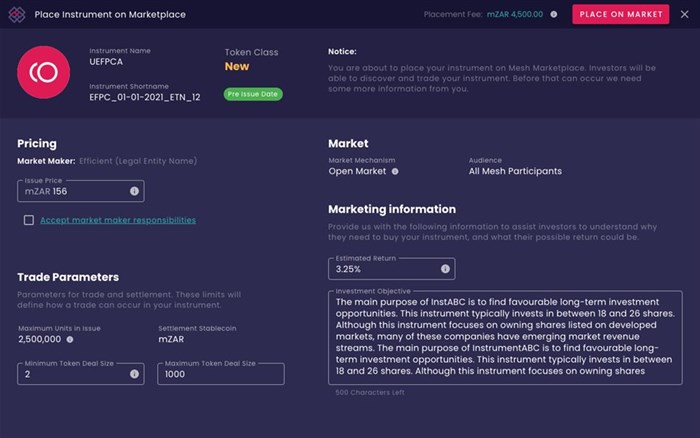

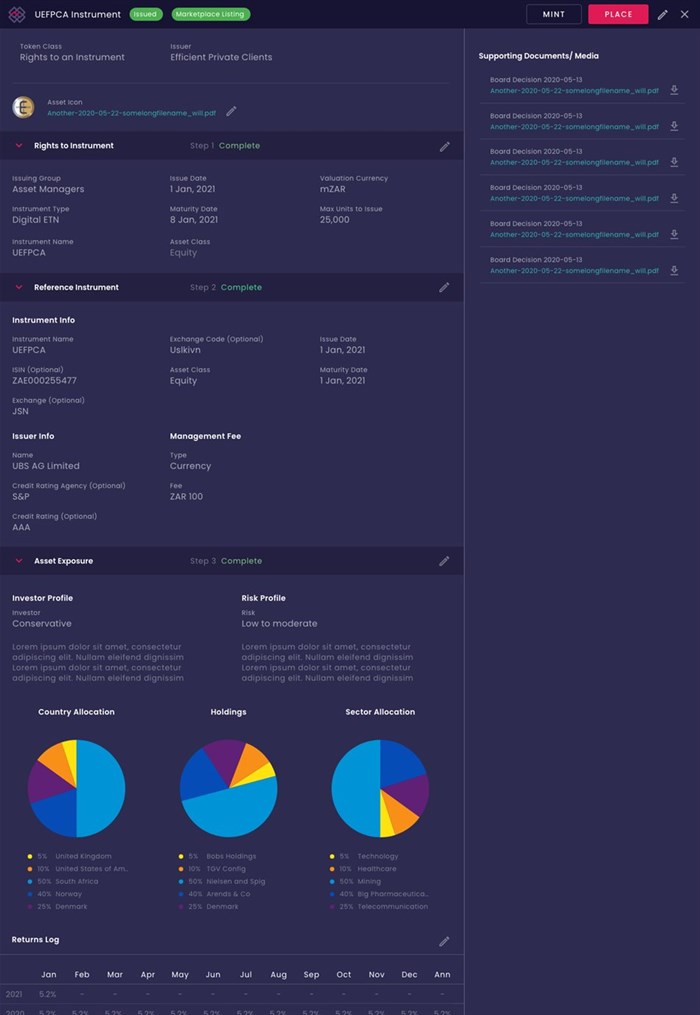

Simply put, this allows companies looking to raise capital by issuing and tokenising real-world financial assets such as equities, preference shares, corporate bonds and other types of debt instruments, to sell these tokenised representations of the underlying assets directly to investors, transferring full and immutable ownership of the assets without the need for brokers or intermediaries to facilitate the trade, explains Luisa Mazinter, chief growth officer of Mesh.trade, a multi-sided, open capital markets platform, that makes it possible for issuers and investors to trade directly with each other, particularly in historically hard to access alternative or private capital assets.

Massive growth in tokenisation

The tokenisation of real-world assets (RWA) is exploding in the finance world and the Boston Consulting Group predicts that the combined value of tokenised financial assets, both liquid and illiquid, such as equities, bonds, real estate, commodities, and others, will approach $16.1tn by 2030, which goes to show how quickly tokenisation is gaining traction.

To prove this point, Galaxy Research says that the market value of tokenisable real-world assets on 1 January 2023 was $1,442,482,959. By the end of September 2023, this value had almost doubled to $2,489,267,856, or almost R50tn. In other words it grew by over a trillion dollars in just nine months.

Benefits of tokenising assets

Despite the noteworthy growth trajectory of real-world asset tokenisation and the broader market’s expectations for even more explosive growth, as an investor you may wonder why this trend should matter to you, especially if you are hesitant to dip your toes into the historically opaque and inaccessible world of the Capital Markets.

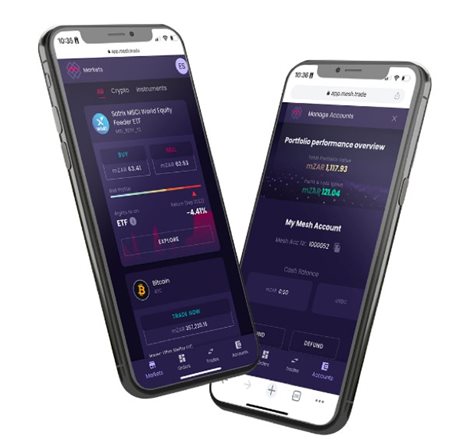

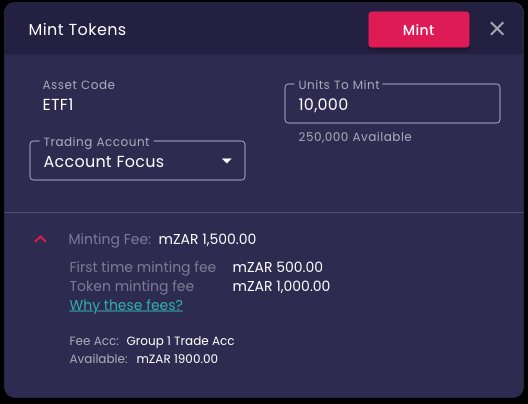

Mazinter explains: “Tokenisation makes it easier for you to get access to a wide range of quality financial assets which have only been accessible to large institutional investors in the past. Assets like corporate bonds or preference shares issued by top-quality, privately-owned companies, that were previously out of reach for most of us, can now be tokenised into smaller fractions, issued and traded on an open capital markets platform like Mesh, making ownership of these desirable assets more affordable and therefore more attainable. Also, due to the baked in cryptographic security of its underlying blockchain technology, intermediaries are not needed to facilitate trade or to be the trusted middlemen between buyer and seller. This eliminates the high costs and long lead times that have always been associated with the very complex, fragmented and expensive world of investing in the capital markets, simplifying the process into a seamless and elegant flow.”

Open and accessible to all

Another reason for joining the tokenisation world is that it is completely transparent. “You, as a buyer, will always know the history and the source of the tokens you are buying, as this is transparent and visible to anyone on the blockchain, a digital ledger that cannot be manipulated and that records and valildates every single transaction that is made."

Radically reduced costs

There are far lower fees compared to traditional investing because with an open capital markets platform such as Mesh.trade, you don’t have to go through a series of intermediaries or pay high brokerage or custody fees, which is a welcome departure from the slow and expensive, administrative machine of traditional asset ownership and transfer.

“Increased accessibility opens capital raising and investment opportunities to a much wider global audience as well as to those who may not have had access to the vast value of the capital markets before. And, due to the very nature of blockchain technology, another key benefit is that tokens host a secure, transparent and immutable record of ownership,” emphasises Mazinter.

Banks are joining in

This rapidly growing sector is not only open to individual and corporate investors. Traditional institutions like banks are joining the movement too and in January 2023, the Dutch bank ABN Amro made headlines by issuing a bond of €450k on the Stellar blockchain. Goldman Sachs, Société Générale and Santander all assisted the European Investment Bank in their €100M 2-year bond issuance last November. J.P. Morgan has also explored how tokenisation can disrupt foreign exchange, completing a cross-currency transaction involving tokenised Japanese Yen and Singapore Dollar deposits among others.

Tokens, as this example illustrates, can be tethered to anything, real or virtual. And the world of big finance is like a sleeping giant that has woken up to this opportunity, particularly in the past year.

Investors gain while Issuers access a new route to market

Capital markets were originally designed to create economic opportunities for all who interact with them, but over time they have become big, expensive, complex and layered. Tokenisation finally liberates these markets by creating a level playing field for both investors and issuers, giving small investors a way to invest early in good companies with high growth potential, and benefiting institutional investors through increased speed and substantial cost savings. On the other side of the market, good quality companies that are looking to issue equity or debt instruments, now also have a credible and viable alternative route to raise capital that is no longer limited to the expensive, slow, traditional channels available to them today.

“The tokenisation of real-world assets, powered by the blockchain, is transforming how the world issues, trades, secures ownership and manages the lifecycle of any traditional financial asset. This is why you should know about it, and why you should care,” concludes Mazinter.

- Mesh makes the ‘magic’ of compounding open to all12 Nov 13:55

- Mesh makes it easy to invest in the BRNDZ you know01 Nov 09:30

- Mesh.trade makes Λnβro Unicorn Global Equity AMC available to South African investors30 Oct 16:20

- It’s time for capital markets to be open to all24 Oct 13:10

- Tokenised ETFs offer attractive investment options26 Jun 12:12

![Source: © MMA {{www.facebook.com/MobileInSA/ MMMA]]](https://biz-file.com/c/2202/646910-300x156.jpg?2)