South Africa’s new-vehicle market suffered its eighth straight month of year-on-year decline in March 2024. Here’s your overview, including Mzansi’s most popular brands…

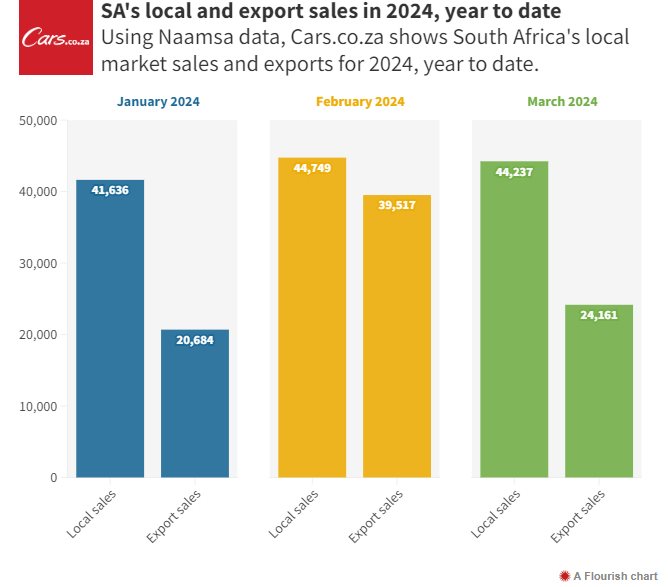

Yes, the weak performance continues. March 2024 was the South African new-vehicle industry’s eighth consecutive month of year-on-year decline, with total market sales falling 11.7% to 44,237 units. That figure furthermore represented a 1.1% drop compared with February 2024’s effort.

The bad news even extended to the export market, which suffered a 27.1% year-on-year decline to 24,161 units in March 2024. According to Naamsa, the market’s overall performance was impacted by a “constrained business environment amplified by weak consumer demand” as well as the recent Easter holidays (the latter resulting in fewer trading days).

Unfortunately, the picture isn’t much rosier year to date. For the first quarter of 2024, for instance, South Africa’s aggregate new-vehicle sales stood at 131, 201 units, some 5.3% below the corresponding three-month period in 2023.

But back to March 2024. Out of the total reported industry sales last month, Naamsa estimated that 39, 016 units (or 88.2%) represented registrations via the dealer channel, while 6.0% were sales to the vehicle-rental industry, 3.5% to government and 2.3% to industry corporate fleets.

The March 2024 new passenger-vehicle market registered a 15.9% year-on-year drop to 26, 577 units, with rental sales accounting for 7.8% of that total. Even the country’s typically robust light-commercial vehicle segment wasn’t spared, with sales in this space declining 4.3% year on year to 14, 870 units.

Meanwhile, Brandon Cohen, chairperson of the National Automobile Dealers’ Association (NADA), commended the country’s dealers for their sales performances amidst what he described as “exceptionally challenging market conditions” in March.

“March presented additional challenges with three public holidays disrupting operations for both dealers and manufacturers. This period coincided with school holidays, further impacting consumer behaviour. Additionally, as March marked the fiscal year-end for many companies, purchasing decisions were influenced by budgetary considerations, resulting in varied trading patterns,” Cohen pointed out.

Lebo Gaoaketse, head of marketing and communication at WesBank, said all was not lost for March sales. He explained that the “particularly early” calendar impact of the Easter public holidays meant March 2024 was a much shorter selling month than March last year (20 selling days versus 22 last year).

“One can hope that April will bounce back and provide some level of correction against last year’s sales,” Gaoaketse said.

New-vehicle sales summary for March 2024

- Aggregate new-vehicle sales of 44, 237 units decreased by 11.7% (5, 877 units) compared to March 2023.

- New passenger-vehicle sales of 26, 577 units decreased by 15.9% (5, 024 units) compared to March 2023.

- New light-commercial vehicle sales of 14 870 units decreased by 4.3% (672 units) compared to March 2023.

- Export sales of 24, 161 units decreased by 27.1% (8, 975 units) compared to March 2023.

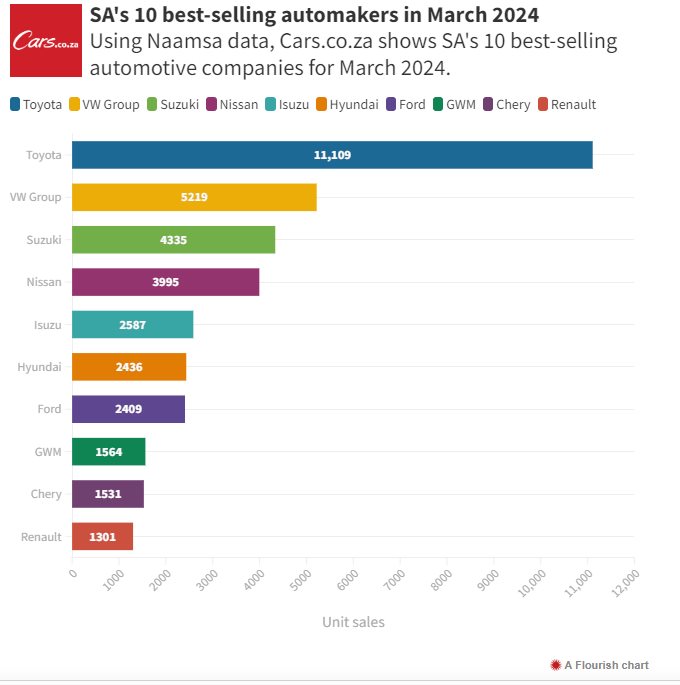

10 best-selling automakers in South Africa in March 2024

Despite the overall negative sentiment, it was another bumper month for Toyota (including the Lexus and Hino marques), which was once again South Africa’s best-selling automaker in March 2024. Last month, Toyota SA Motors registered as many as 11,109 units (4,352 of which came in the light-commercial vehicle segment) around Mzansi, just 3.6% down on its February 2024 showing.

The Volkswagen Group (including the Audi marque) likewise held steady in second position, with 5,219 units sold. After breaching the 5,000-unit mark for two months on the trot, Suzuki Auto SA fell back to a still-solid 4,335 sales in March 2024, opening up some space between it and the VW Group but still retaining third.

Intriguingly, Nissan found itself just 340 sales off the pace in fourth position. The Japanese firm’s local division ended March 2024 on a surprisingly heady 3, 995 units (up a whopping 45.9%, month on month, with much of that growth seemingly in the light-commercial vehicle segment), easily its best effort in recent memory. Isuzu (2,587 units), meanwhile, climbed two rankings to fifth place, with Hyundai (2, 436 units) holding steady in sixth.

That saw Ford (2,409 units) slip two spots to seventh, with GWM SA – recently renamed from Haval Motors SA – again taking eight, this time on 1, 564 units. Chery (1, 531 units) was once more right on its fellow Chinese group’s tail in ninth, while Renault (1,301 units) again closed out the table in 10th.

Outside of the top 10, Naamsa’s figures furthermore suggested Mahindra finished in 11th on 1,163 units, putting the Indian automaker ahead of the BMW Group (1,068 units), Kia (1,007 units) and Mercedes-Benz (with a Naamsa-estimated 567 units).

1. Toyota – 11, 109 units

2. Volkswagen Group – 5, 219 units

3. Suzuki – 4, 335 units

4. Nissan – 3, 995 units

5. Isuzu – 2, 587 units

6. Hyundai – 2, 436 units

7. Ford – 2, 409 units

8. GWM – 1, 564 units

9. Chery – 1, 531 units

10. Renault – 1, 301 units

New vehicle-sales outlook in SA for remainder of 2024

So, where to from here for South Africa’s new-vehicle market? Well, Naamsa suggests the market looks set to continue on this “downward slope”, though believes “better economic prospects are expected for the new-vehicle market” once the anticipated interest-rate cutting cycle commences – likely only during the second half of the year.

“Due to ongoing cost pressures, including escalating fuel costs, along with interest rates, affordability remains a decisive factor in purchasing decisions as consumers increasingly turn to more budget-friendly vehicles,” says Naamsa, adding that SA’s economic growth outlook for 2024 remains muted (though hopefully still stronger than in 2023).

What about the export market? Well, the industry representative body says “prospects for the balance of the year remain upbeat on the back of new-model introductions by major exporters, while the global economic cycle is expected to bottom out in the first half of 2024”.

“Lower inflation, central bank easing and modest global economic growth are therefore expected to support the South African automotive industry’s export performance,” Naamsa concludes.

NADA’s Cohen says the “consistent resilience and adaptability demonstrated by South Africa’s franchised motor dealers are indicative of their enduring strength in navigating dynamic market conditions”.

“While the month marked a continuation of declining retail vehicle sales, insights suggest promising fiscal performances for several industry stakeholders. As we move forward, our focus remains on building momentum and driving growth within the retail automotive sector,” says Cohen.

Meanwhile, WesBank’s Gaoaketse believes the market will “inevitably also be cautious” with pending elections in May, potentially further dampening year’s opening half performance.

“The broader economy remains a challenge for South African motorists. With interest rates unchanged once again, they remain high amidst generally high inflation. Fuel prices will increase again this week, continuing to place pressure on household budgets and their ability to service debt,” cautions Gaoaketse.

This article was originally published on Cars.co.za...