Despite ferocious tales and innuendos of TV advertising “dying”, the truth is that TV advertising continues to dominate media budgets in South Africa. According to Nielsen, over R23bn was spent on TV advertising in 2018 (excluding self–promotion) a 5% increase from 2017. For some naysayers, the TV glass will remain half empty, where arguments will be made around supplementing marketing budgets with other media touchpoints. We know from the Kantar CrossMedia database (looking at over 600 multi-channel campaign performance) that TV remains the king of building reach. This is not to say that other channels cannot deliver great levels of reach, but building reach quickly, remains the core strength of TV in South Africa.

BrandingKantar 19 Nov 2019

We also know that TV in the media mix allows other channels to perform better in delivering overall brand impact. In the below case study, non-TV media do perform alone but they do much better with TV priming (TV flighted first in a campaign). TV is often the “glue” which holds multichannel campaigns together, so there is strong merit in ensuring TV marketing is optimised! Analysis of the Adtrack™ database shows that from January to March this year, a massive 77% of all ads have failed to resonate effectively with consumers. 49% of all new ads achieved below average cut through at launch, which means every second ad launched on TV is a complete waste of media investment. Over time it would appear that brands are investing more behind lack luster executions, as the trend of below average ads continues to rise over time. The best chance of winning is if you are a brand operating in categories which consistently over index in terms of recall. The top categories include carbonated soft drinks, fast food/restaurants, coffee creamers, retail groceries, dental, telecommunications/ITC, fruit juice, long-term insurance, banking, alcoholic beverages and household cleaning.

AdvertisingKantar 17 Jan 2018

If your brand doesn’t operate in these categories, you can easily see how misleading category-only norms could be, as it is not only the competition within your category you should be concerned with, but rather cutting through the whole mental space available to consumers.

ResearchLeigh Andrews 11 Jul 2019

Almost 80% of all new TV brand ads have failed to cut-through the clutter.

Consumers mental capacity to recall TV advertising is diminishing over time

The average noting norm in South Africa is a mere 17%. Although this does vary across categories, consumers do not see advertising for categories in isolation and as such it is key to understand the impact of a campaign in the context of all campaigns in the market. Over time the average South African noting norm has been on a steady decline, indicating that consumers mental capacity to recall TV advertising in the clutter is diminishing over time.

Not all performance is equal

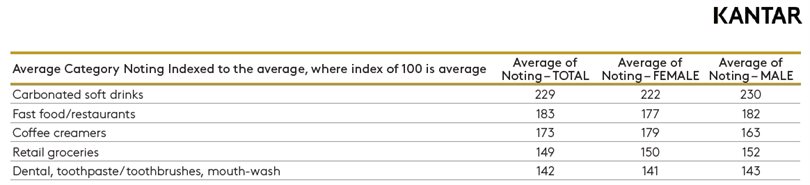

Performance of cut-through varies greatly by category, brand and target audience. Fast Food (or QSR) brand ads tend to resonate more strongly across South Africa, as such the average for these brands is much higher than the South African average. Each category will have its own unique challenges and a unique ROI calculation is needed for each category and target audience. Some categories have failed to produce any marketing value for brands (household income of less than R10,000 per month), meaning that almost R7 out of every R10 spent on TV was a fruitless marketing endeavour. The following table illustrates category ranking in terms of average noting vs. the South African average. Scores have been indexed to 100, where 100 is average. For easy reference, the index illustrates how effective advertising (in a particular category) vs. all advertising in South Africa. This list incorporates overall, or meta, categories only. Detailed category analysis has not been included in this report, however is available.

In the case of carbonated soft drinks (for example), advertising is 129% more effective than the average ad in South Africa. Amongst the categories with the least effective advertising, we see some big TV spenders, electronics, beauty/ cosmetics, automotive, medical aid insurance and investment brands. On average these categories produce less effective advertising compared to the stock standard ad you see on TV. This is why simply comparing TV effectiveness within a category offers potential pitfalls. As a brand, it is important to look beyond just the category you operate in and sense check (at least every so often) that your adverts are actually making it into consumers’ mind that are already cluttered with the deluge of adverts faced daily.

AdvertisingKantar 10 Jul 2019

*Adtrack™ is Kantar’s proprietary advertising testing system, evaluating the impact and liking of all new brand advertising in South Africa for over 35 years. TV effectiveness insights in this section are based on key findings database analysis across the last five years.

To find out more contact:

Monique Claassen, Head of Media & Digital, Kantar South Africa

e. moc.ratnak@nessaalc.euqinom

t. 010 036 0600

AdvertisingKantar 3 Oct 2019